Collaborative AI Project – Can Machine Learning Predicting Stock Trends?

Project information

- Project Date: 01/2024

- Project URL: GitHub - Project Algorithm Trading Team1

- Skills: Python, Data Visualisation

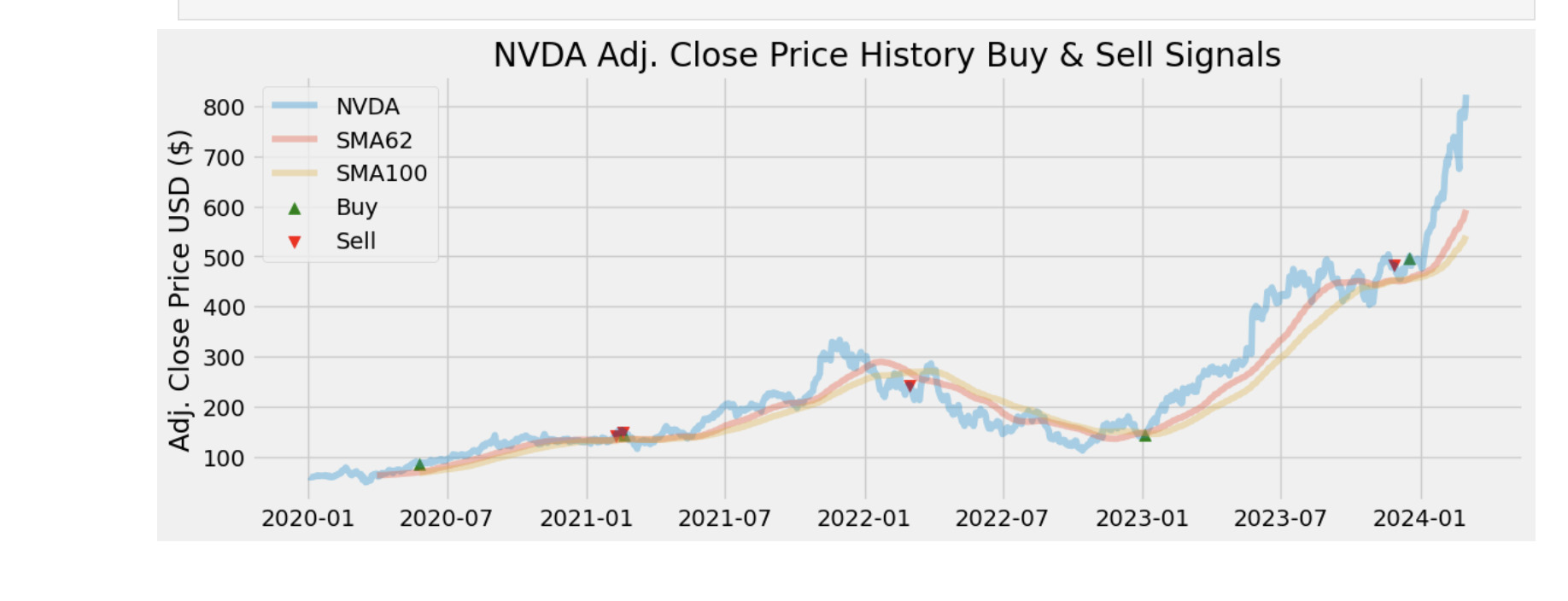

This project takes you behind the scenes of a stock trading strategy, using the ever-popular

Simple Moving Average (SMA) crossover method. The mission? To see how well this classic

strategy would have worked on NVIDIA (NVDA) stock between 2013 and 2019. With a starting budget of $50,000

and no fixed deposit rate, the idea is to simulate buy and sell signals based on the crossover

of short-term and long-term SMAs—and judge if it could have made you some serious cash.

Here’s the play: we’ve got two SMAs in action here. One’s got a short window of 62 days,

while the other stretches over 100 days. When the short-term SMA crosses above the long-term

one, we get a buy signal, hinting that the stock might be on the up. When the short-term SMA

crosses below the long-term, it’s a sell signal, suggesting a dip ahead. All of this is tracked

visually on the price data, so you can literally see how your trades would have panned out.

The goal? To take a look back at history, track how well this strategy could’ve worked, and give insights into

how a trader might have performed over that 6-year window. And, guess what? Our group came out on top, finishing

first place with our analysis and execution of this strategy!